ABSOLUTE DIRECTIVE: TITLE FULFILLMENT

Buffett's Big Cash Pile: A Signal?

Warren Buffett, the Oracle of Omaha, has been making headlines again – not for a brilliant new investment, but for something far more telling: sitting on a mountain of cash. Berkshire Hathaway's latest filings show a staggering $381 billion in cash and short-term investments as of Q3 2025. But here's the kicker: for the past 12 quarters, Buffett has been a net seller of stocks, to the tune of $184 billion. That's a lot of chips pulled off the table.

Market Overvaluation Concerns

Now, the financial press is buzzing. Is this a sign that Buffett, who turns 96 this year, sees something the rest of us are missing? The implication is clear: the market is overvalued, and a correction is coming. The S&P 500's cyclically adjusted price-to-earnings (CAPE) ratio is being trotted out as Exhibit A. In November, it hit 40, a level seen only a handful of times in the past seven decades. And historically, those occasions haven't exactly been followed by champagne and confetti.

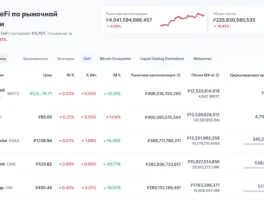

CAPE Ratio and Historical Returns

The data doesn't lie. When the CAPE ratio hits 40 or higher, the S&P 500's subsequent returns have been, shall we say, underwhelming. The average return over the next three years has been a negative 30%. The worst-case scenario? A 43% decline. Not exactly the kind of numbers that inspire confidence.

The Forward-Looking Perspective

But here's where things get interesting. The CAPE ratio, while a useful metric, is backward-looking. It's based on the past decade's earnings. What really matters is what happens to earnings going forward. And that's where the argument gets a bit more nuanced.

AI: The Great Earnings Wildcard

The optimists argue that we're entering a new era of productivity, driven by – you guessed it – artificial intelligence. They point to the fact that the S&P 500's net profit margin has already expanded by 4.4 percentage points in the last decade, thanks to lower corporate tax rates and technological innovation. (The tax cuts, passed in 2017, are a major factor.) The hope is that AI will supercharge this trend, leading to even fatter profit margins and justifying today's lofty valuations.

The Hype vs. Reality of AI

But is that realistic? I've looked at hundreds of these earnings reports, and while the promise of AI is everywhere, the actual impact on the bottom line is still hazy. It's a lot of hype and not a lot of hard numbers. Companies are spending billions on AI initiatives, but it's not yet clear whether those investments will pay off in a big way.

Buffett's Strategy: Prudence or Succession Planning?

And this is the part of the report that I find genuinely puzzling. If Buffett is so concerned about market valuations, why isn't he shorting the market? Why isn't he using his massive cash pile to bet against the overvalued stocks he's so worried about? The fact that he isn't suggests that his concerns, while real, aren't quite dire enough to warrant a full-blown bet against the market. Perhaps he's simply being prudent, positioning Berkshire Hathaway to weather a potential storm without actively trying to profit from it.

The Succession Factor

Of course, there's another possibility: Buffett's getting ready to retire. On January 1st of 2026, Greg Abel will be taking over as CEO. Maybe, just maybe, Buffett is clearing the decks, simplifying the portfolio, and ensuring that his successor has plenty of dry powder to work with. Warren Buffett, Weeks Before His Retirement, Has a Warning for Wall Street. History Says This May Happen in 2026.

Buffett's Not Panicking, and Neither Should You

The S&P 500 Shiller CAPE ratio also has been on the rise prior to these stock market dips, suggesting valuation may play a role in this trend. This historical pattern suggests we may see a dip in stocks in 2026 -- but this doesn't necessarily mean that the year will finish in the negative. Stock market declines that have followed Buffett's increases in cash levels generally have been short-lived, and most important of all, the S&P 500's declines always have resulted in recovery and gains in the years to follow.

So, What's the Real Story?

Buffett's cash hoard is a warning, yes, but not a death knell. It's a reminder that valuations matter, that markets don't always go up, and that even the greatest investors in the world can't predict the future with certainty. What it doesn't mean is that you should panic and sell all your stocks. It means you should be choosy, like Buffett, about which stocks you own, and be prepared to hold them through thick and thin. It means understanding the difference between hype and reality, especially when it comes to the transformative power of artificial intelligence. And most of all, it means remembering that investing is a long game, not a sprint.