Crypto Crime in 2025: A Grim Outlook

Alright, so 2025 is shaping up to be a banner year for crypto crime, huh? Hacken says $3.1 billion GONE in the first six months. Chainalysis chimes in, saying it's worse than all of 2024. CertiK points the finger at us, the individual users. Great. Just f*ing great.

The "New" Threat Landscape (Spoiler: It's the Same)

Malware targeting wallets? Phishing scams? Smart contract risks? Give me a break. This ain't new, folks. It's the same old song and dance, just with a fresh coat of paint and maybe a slightly more sophisticated beat. They're acting like AI deepfakes are some revolutionary new threat, but let's be real – people have been getting conned since the dawn of time. It's just that now the con artists have better tools.

And this "Malware-as-a-Service" crap? Seriously? You can buy ready-made malware on the dark web? So, what, now even the criminals are outsourcing? This is peak capitalism right here. I bet there's a SaaS for ransomware coming soon...actually, don't give anyone any ideas.

The article mentions browser add-ons mimicking MetaMask and Coinbase. Okay, but who's falling for this? Are people really that clueless? Maybe they are. I dunno. It's depressing to think about.

Hardware Wallets: The "Solution" That Isn't

Of course, Ledger's pushing their hardware wallets as the ultimate solution. "Store your private keys in an environment isolated from the internet!" Groundbreaking stuff, people. It's not like we haven't been hearing that for the last decade. You can find a detailed breakdown of hardware wallet security in Crypto Wallet Security Checklist 2025: Protect Crypto with Ledger.

And then they have the audacity to say, "Malware scams are impossible to avoid while using a software (hot) wallet." Well, no sht, Sherlock. That's why hardware wallets exist. But here’s the kicker: even hardware* wallets aren’t foolproof. Supply chain attacks are a real thing. Someone could tamper with the device before it even gets to you. So, what then?

They talk about "clear signing" – making sure you can see exactly what you're signing on the device's screen. Okay, that's nice. But are we really supposed to audit every single transaction like we're f*ing cybersecurity experts? I don't have time for that. I just want to buy some goddamn crypto and hope it goes up. Is that too much to ask?

And segregation of assets? Splitting your crypto across multiple wallets? Seriously? So now I have to manage a dozen different wallets, each with its own seed phrase? My brain hurts just thinking about it. And what if I lose one of the seed phrases? Am I just screwed? Great.

The Regulatory Nightmare and Meme Coin Mania

Oh, and let's not forget the regulatory landscape. "Regulations are still evolving in the digital asset space," they say. Evolving into what? A tangled mess of conflicting laws and bureaucratic red tape? I wouldn't be surprised.

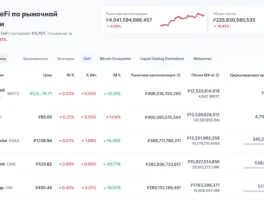

And then there's the meme coin mania. Dogecoin, Shiba Inu, PEPE... It's like the entire crypto market has turned into a giant joke. People are throwing their money at digital tokens based on memes, with absolutely no underlying value. It's insane.

"Meme coin investing is risky," the article warns. No freakin' kidding. But people are still doing it. Why? Because they're greedy and they think they can get rich quick. And some of them will. And the rest of them will lose their shirts. It's the circle of crypto life.

We're All Gonna Die (Financially, At Least)

So, are we doomed? Probably. The hackers are getting smarter, the scams are getting more sophisticated, and the regulators are getting more clueless. We're fighting a losing battle. The only way to truly protect your crypto is to not own any in the first place. Which, offcourse, defeats the whole purpose.

Then again, maybe I'm just being a cynical old bastard. Maybe there's still hope for crypto. Maybe the technology will mature, the regulations will become clearer, and the scams will become less prevalent. But I wouldn't bet on it.