Alright, lemme get this straight. So, after another crypto crash that probably wiped out a few more "get rich quick" schemes, we're supposed to be impressed that *some* DeFi tokens are doing...less bad? FalconX is calling them "safer names with buybacks." Give me a break.

"Least Damaged Building After a Nuclear Strike" = Success?

The Illusion of Safety in a Collapsing Market

Down 16% QTD is now considered a win? HYPE and CAKE are the *best* performers? That's like celebrating the least damaged building after a nuclear strike. Sure, it's still *standing*, but do you really want to live there?

And this whole "investors are crowding into lending names" thing? Please. It's not because they're suddenly smart. It's because they're panicking and looking for anything that looks remotely stable. Lending and yield are "stickier than trading activity"? Only until the whole damn thing collapses.

It's like musical chairs, but instead of one chair being removed, someone just sets the entire room on fire.

DeFi's "Shifting Landscape": Or Just a Slow-Motion Trainwreck?

Valuation Games: Smoke and Mirrors

Oh, and the valuation landscape is "shifting." Of course it is. Everything's shifting when the ground is crumbling beneath your feet. Spot and perpetual DEXes have "declining price-to-sales multiples." Translation: they're losing money faster than they're losing value.

CRV, RUNE, and CAKE posted "greater 30-day fees." Okay, great. So they're still making *some* money. Does that change the fact that the entire DeFi sector is still a house of cards waiting to fall? I don't think so.

Hyperliquid (HYPE), which by the way, who names these things? Seriously. Anyway, HYPE's relative outperformance "may point to investor optimism around its ‘perps on anything’ HIP-3 markets." Or maybe it just means they're better at marketing to desperate gamblers.

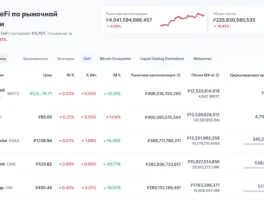

DeFi Token Performance & Investor Trends Post-October Crash.

DeFi Crystal Ball: More Like a Magic 8-Ball

The 2026 Crystal Ball: More Wishful Thinking

This whole report is basically just analysts trying to justify their existence. "This positioning may reflect where investors think the DeFi sector will see growth in 2026." May? MAY?! They're guessing! They're paid to make educated guesses, but let's be real, it's still just throwing darts at a board in the dark.

Fintech integrations driving growth? AAVE's high-yield savings account? Morpho's Coinbase integration? That's what we're pinning our hopes on? It all sounds like desperate grasping at straws to me.

Details on *why* investors are making these decisions remain scarce, ofcourse. We're just supposed to trust that "investors expect perps to continue to lead." Expect? Based on what? A feeling? A lucky guess? A poorly-sourced Reddit thread?

I mean, are we really supposed to believe that these shifts mark the beginning of a broader shift in DeFi valuations, or if these will revert over time? And honestly...who the hell knows?

Give Me a Break...

All this "analysis" boils down to one simple truth: DeFi is still a risky, volatile mess. Some tokens might be doing slightly better than others, but that doesn't make them safe. It just makes them the least likely to sink *immediately*.