The Truth Lies in the Code

Introduction

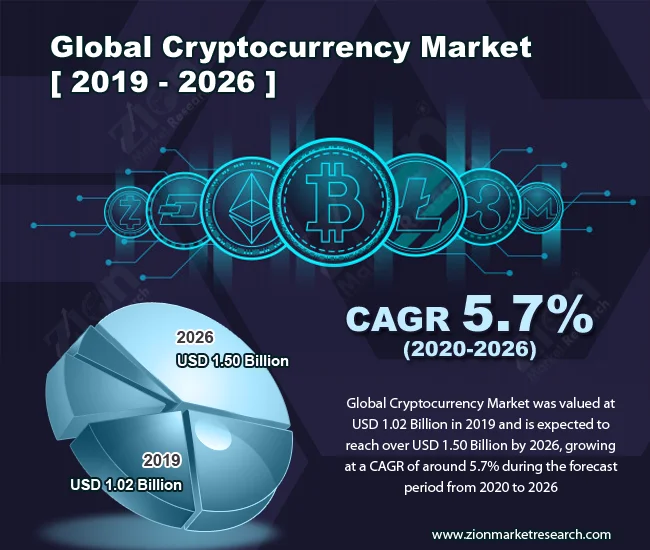

TRM Labs' 2025/26 Global Crypto Policy Review & Outlook paints a picture of a maturing crypto market, one where regulatory clarity is driving institutional adoption and tamping down illicit finance. Stablecoins are the star of the show, with over 70% of jurisdictions reviewed advancing new regulatory frameworks. That's the narrative, anyway. But as someone who used to sift through quarterly reports for a living, I'm trained to look past the headlines and into the underlying data. And when I do that here, I see a story that's a little more nuanced – and a lot more interesting.

Stablecoins: Stability or Stagnation?

Regulatory Frameworks vs. Success

The report emphasizes stablecoins as the "entry point for institutional adoption," citing their stability and blockchain-native efficiency. And it's true, stablecoin regulation is indeed accelerating. The US GENIUS Act, the EU's MiCA rollout, and progress in Hong Kong, Japan, Singapore, and the UAE all point to a global push for bespoke regulatory frameworks. But let's be real: regulatory frameworks aren't always synonymous with success. In fact, sometimes, they're the kiss of death (or at least a long, slow decline).

Growth Rate and User Adoption

The report notes that stablecoins reached a record high in 2025, but fails to mention the actual growth rate of those highs. Is it organic, user-driven adoption, or is it simply the result of regulatory pressure pushing institutions into a specific, easily-monitored asset class? Regulation doesn't equal innovation; sometimes, it equals stagnation. Are we seeing genuine demand, or just forced compliance? I'd like to see a deeper dive into transaction volumes, user demographics, and the actual use cases driving this supposed adoption. Are stablecoins truly facilitating payments and settlements, or are they just sitting in custodial wallets, waiting for the next regulatory shoe to drop?

Central Bank Digital Currencies (CBDCs)

Moreover, if stablecoins are truly becoming "true mediums of exchange," as the report claims, why are central banks still so obsessed with their own CBDCs? The ECB, for example, is still pushing forward with the digital euro, despite acknowledging the challenge of competing with USD-denominated stablecoins. This suggests that regulators aren't entirely convinced by the stablecoin narrative, and are hedging their bets with a more centralized, controlled alternative.

Institutional Adoption: Hype or Reality?

Nature of Digital Asset Initiatives

The report claims that about 80% of reviewed jurisdictions saw financial institutions announce digital asset initiatives in 2025. That's a big number, but what kind of initiatives are we talking about? Are they truly groundbreaking, or are they just PR stunts designed to appease shareholders and appear "innovative"?

Basel Committee's Reassessment

Here's where I start to get skeptical. The report mentions the Basel Committee's reassessment of its proposed prudential rules for banks' crypto exposures, noting that major jurisdictions like the US and UK declined to adopt the original framework. This is framed as a "softening of regulatory attitudes," but it could just as easily be interpreted as a sign that regulators are struggling to adapt to the rapidly evolving crypto landscape. Are they truly embracing digital assets, or are they simply kicking the can down the road, hoping the problem will solve itself?

Regulatory Clarity and Confidence

And this is the part of the report that I find genuinely puzzling. If institutional adoption is truly being "fueled by regulatory clarity," why is the Basel Committee reconsidering its rules? Shouldn't clear rules lead to more confidence, not less? The fact that regulators are still debating the fundamentals suggests that the picture is far from clear.

The Illusion of Global Consistency

Divergence in MiCA Implementation

One of the report's key takeaways is the "importance of global consistency" in crypto regulation, warning against regulatory arbitrage. This is a valid concern, but the report itself undermines this argument by highlighting the "divergence in MiCA implementation" within the EU. France, Austria, and Italy are calling for stronger EU-level oversight, citing "major differences in how crypto markets are being supervised by national authorities."

Conflicting Regulations

So, which is it? Is the world moving towards global consistency, or are we seeing a patchwork of conflicting regulations that create more confusion than clarity? The report can't have it both ways.

Bybit Hack and Illicit Activity

The report also mentions North Korea's record-breaking hack on Bybit in early 2025, which led to the exchange losing over USD 1.5 billion in Ethereum tokens. This incident, the report claims, "illustrated how illicit actors exploit unregulated or lightly supervised technologies to obscure funds." But let's be precise – to be more exact, the report states that the hack was on Bybit, but the laundering was through unlicensed OTC brokers, cross-chain bridges, and decentralized exchanges. The hack itself wasn't due to "unregulated technologies," it was due to a failure of security protocols at a regulated exchange. This distinction matters.

The Data's Incomplete

Limited Jurisdictional Coverage

The TRM Labs report is valuable in that it offers a broad overview of global crypto policy. But it's important to remember that it's just one perspective, and it's based on a limited set of data. The report focuses on 30 jurisdictions, representing over 70% of global crypto exposure. That leaves a significant 30% unaccounted for. What's happening in those other jurisdictions? Are they lagging behind in regulation, or are they forging their own, unique paths?

Reliance on Policy Statements

Furthermore, the report relies heavily on announcements and policy statements, which don't always translate into real-world action. I'd like to see more quantitative data on enforcement actions, illicit finance rates, and the actual impact of regulation on market behavior. Without that, it's hard to say whether the policies being implemented are truly effective, or just window dressing.

Data-Driven Delusions

Illicit Activity Rates at VASPs

The report claims that VASPs (Virtual Asset Service Providers), "have significantly lower rates of illicit ac